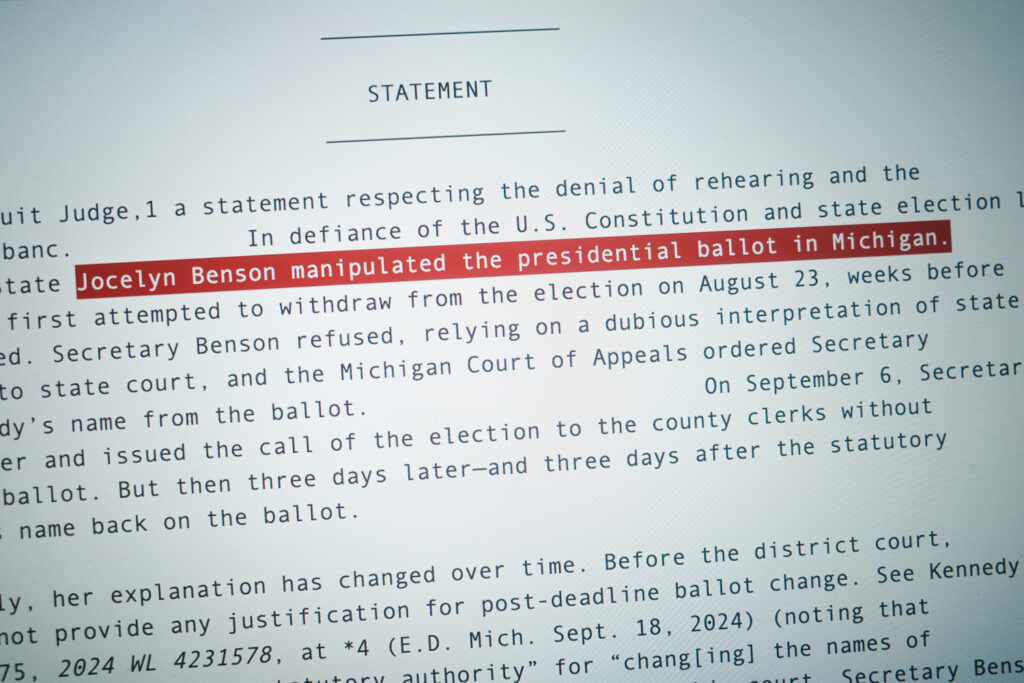

The Michigan Legislature just passed a new 24% wholesale tax on cannabis as part of the state’s road funding bill. Backed by Gov. Gretchen Whitmer, the bill enjoyed fairly wide bipartisan support across both chambers of the Legislature, despite all the industry backlash.

The tax may be greedy, but honestly, Michigan’s stoners have no right to complain, and neither does the corporate cannabis industry. Without taxes, the industry would collapse—they’re the only reason it exists at this scale in the first place.

Dear lord, no one is more spoiled right now than weed smokers in Michigan. Weed is 10 times cheaper and 10 times stronger now than it was a decade ago. It’s sold out of storefronts in broad daylight now, not some shady guy’s basement. Have some perspective, folks.

Weed is, on average, $60 an ounce now. You can find it cheaper too. Even the middling stuff hovers around 20% THC content, which was the absolute top end a decade ago. Maybe everyone’s tolerance is through the roof because of this, and 20% doesn’t cut it anymore, but the grass out there now is rocket fuel compared to the 2010s.

Cannabis is the only commodity we’ve seen get cheaper in our lifetimes, and the economics of growing it will continue to drive prices downwards. It’s supply and demand: The more weed that’s grown, the cheaper it gets. New taxes will hike the price for a bit, but they’ll drop back down inevitably.

This is a huge problem for the cannabis industry. The basic economics of growing weed forces downward price pressure as the industry expands.

A new tax, especially a wholesale tax, hurts growers and dispensaries more than anyone. This is true. But in the same vein, the cannabis industry only exists at the level it does because of these taxes, because the government has created this unwieldy regulatory cartel.

Regulation and taxes, ironically, are the only things keeping cannabis prices afloat.

Without the exorbitant business capitalization requirements and stringent regulations on growers, the barrier to entry for new growers would be far lower. Cannabis prices would drop astronomically as more supply hits the market. Growing at industrial scale in big warehouses, with grow lights and constant power usage, would be unsustainable.

The cannabis industry made a deal with the devil just to bring itself into existence, and it’s been fairly lucrative so far, with hundreds of millions of dollars added to the state’s coffers each year. Now the state wants more. They see a cash cow, and the industry balks.

Yes, this new tax will hurt their bottom lines dramatically, it’s true. Particularly because it’s a wholesale tax on the growers themselves, requiring collection and payment when growers transfer the plants to distributors.

It’s coming at a bad time for the market too. After rapid initial growth, sales have largely plateaued the last two years.

Some dispensaries are closing, even—a major producer, with 20 dispensaries and four commercial grow operations, just announced they’re exiting the Michigan altogether, with their CEO citing Michigan as an “extremely difficult marketplace” due to oversupply.

The tax will, no doubt, exacerbate these problems. Cannabis industry leaders are protesting out of self interest and can’t be blamed for that. But they need to remember that, first of all, their industry only exists because of this absurd regulatory scheme the state cooked up. The devil always gets his due.

The option that no one is talking about is deregulating the cannabis growing industry altogether. If cannabis was allowed to be grown like any other crop, prices would fall down to mere dollars an ounce.

Abandoning the extremely expensive regulatory requirements for commercial growing would allow small-scale farmers to compete. Just another cash crop like heirloom tomatoes, in the end. Treat it like wine, tax it at the point of sale, only let adults buy it, but leave the government out of the growing process.

This would, of course, collapse the current, bloated corporate cannabis industry, already facing decline. It would mean, more than likely, less tax revenue for the government as well, as prices decrease.

Neither side in the current debate wants this. They want to continue this overregulated, bloated government control over the the market, which benefits both state tax revenues and the cannabis industry. They just disagree on who should get the lion’s share.

Deregulation would be something new and intriguing for farmers and consumers alike. It could lead to a more wholesome cottage industry of local growers and sellers, similar to what used to exist under Michigan’s medical “caregiver” model. Even with cheaper prices now, many Michigan stoners remember that old system fondly.

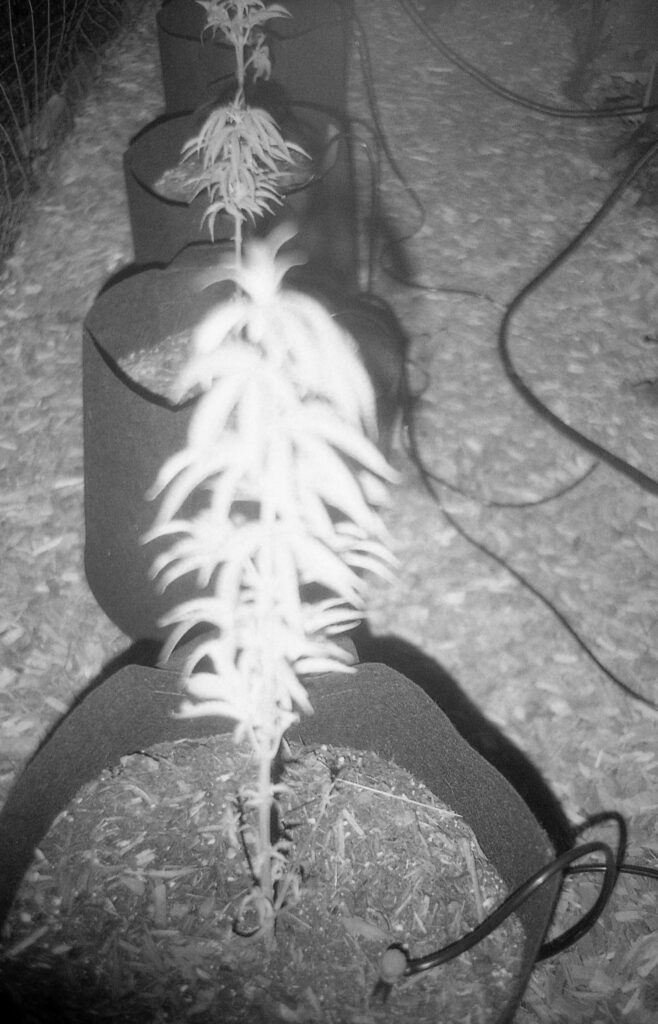

In the meantime, Michigan’s weed enjoyers should remember that they have another option. They can simply grow their own herb. Twelve plants max, but that’s more than enough if you do it right. Seeds are cheap, grow the plants outdoors, cure the buds in a jar for a few weeks. It isn’t rocket science.

You could yield pounds of cannabis flower with nothing but water, soil, and sunlight. It might not be 35% THC gasoline, but do you really need that? Maybe you’d be less paranoid and feel some chiller vibes smoking that homegrown outdoor stuff, man.

So if you want to skip the taxes, take a little initiative and learn how to garden. Until then, spare us the bellyaching, even though we know the state’s new tax is greedy.

Bobby Mars is art director of Michigan Enjoyer. Follow him on X @bobby_on_mars.